Page 82 - Azerbaijan State University of Economics

P. 82

N.V. Abdullayeva: Value creation through mergers and acquisitions in energy sector

of a firm. Event study approach has been used by Fama (1969), Brown and Warner

(1980), Bowman (1983), Peterson (1989), Salinger (1992), and McWilliams and Siegel

(2001). One of the biggest advantages of this study method is that Event study is based

on the assumption that if players in the market are rational, then any event related to the

company will be incorporated in its stock prices immediately.

When utilizing the event study there is no unique structure, but there is a

common flow of analysis. In his paper MacKinlay (1991) indicated main steps of an

event study:

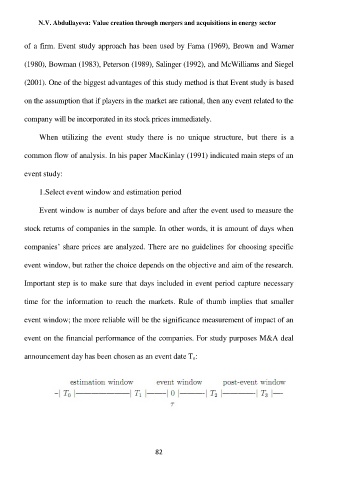

1.Select event window and estimation period

Event window is number of days before and after the event used to measure the

stock returns of companies in the sample. In other words, it is amount of days when

companies‘ share prices are analyzed. There are no guidelines for choosing specific

event window, but rather the choice depends on the objective and aim of the research.

Important step is to make sure that days included in event period capture necessary

time for the information to reach the markets. Rule of thumb implies that smaller

event window; the more reliable will be the significance measurement of impact of an

event on the financial performance of the companies. For study purposes M&A deal

announcement day has been chosen as an event date Tₒ:

82