Page 36 - Azerbaijan State University of Economics

P. 36

Murad Y. Yusıfov: Econometrıc Assessment Of Optımal Interest Burden: Case Study For Azerbaıjan

ANNEX B

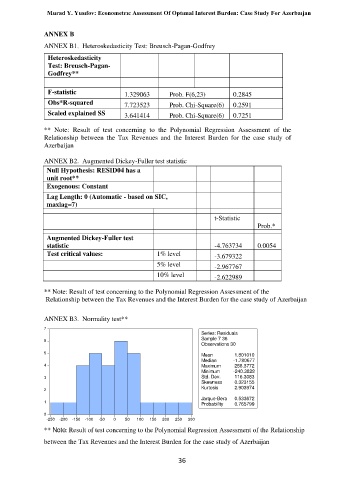

ANNEX B1. Heteroskedasticity Test: Breusch-Pagan-Godfrey

Heteroskedasticity

Test: Breusch-Pagan-

Godfrey**

F-statistic 1.329063 Prob. F(6,23) 0.2845

Obs*R-squared 7.723523 Prob. Chi-Square(6) 0.2591

Scaled explained SS 3.641414 Prob. Chi-Square(6) 0.7251

** Note: Result of test concerning to the Polynomial Regression Assessment of the

Relationship between the Tax Revenues and the Interest Burden for the case study of

Azerbaijan

ANNEX B2. Augmented Dickey-Fuller test statistic

Null Hypothesis: RESID04 has a

unit root**

Exogenous: Constant

Lag Length: 0 (Automatic - based on SIC,

maxlag=7)

t-Statistic

Prob.*

Augmented Dickey-Fuller test

statistic -4.763734 0.0054

Test critical values: 1% level -3.679322

5% level

-2.967767

10% level -2.622989

** Note: Result of test concerning to the Polynomial Regression Assessment of the

Relationship between the Tax Revenues and the Interest Burden for the case study of Azerbaijan

ANNEX B3. Normality test**

7

Series: Residuals

Sample 7 36

6

Observations 30

5 Mean 1.801010

Median -1.780677

4 Maximum 258.3772

Minimum -240.3828

3 Std. Dev. 116.3083

Skewness 0.323155

Kurtosis 2.903974

2

Jarque-Bera 0.533672

1 Probability 0.765799

0

-250 -200 -150 -100 -50 0 50 100 150 200 250 300

** Note: Result of test concerning to the Polynomial Regression Assessment of the Relationship

between the Tax Revenues and the Interest Burden for the case study of Azerbaijan

36