Page 27 - Azerbaijan State University of Economics

P. 27

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.82, # 1, 2025, pp. 19-35

Appendix C presents a summary of the consistency and divergence in M-Score

calculations based on the Beneish and Roxas models, allowing for a comparative

interpretation of results for the 50 marketing companies analyzed for the period 2023–

2024.

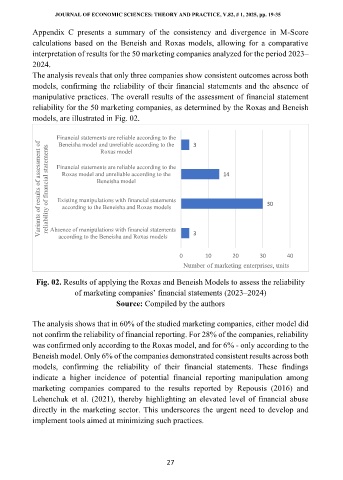

The analysis reveals that only three companies show consistent outcomes across both

models, confirming the reliability of their financial statements and the absence of

manipulative practices. The overall results of the assessment of financial statement

reliability for the 50 marketing companies, as determined by the Roxas and Beneish

models, are illustrated in Fig. 02.

Financial statements are reliable according to the 3

Variants of results of assessment of reliability of financial statements Financial statements are reliable according to the 14 30

Beneisha model and unreliable according to the

Roxas model

Roxas model and unreliable according to the

Beneisha model

Existing manipulations with financial statements

according to the Beneisha and Roxas models

Absence of manipulations with financial statements

according to the Beneisha and Roxas models

0 3 10 20 30 40

Number of marketing enterprises, units

Fig. 02. Results of applying the Roxas and Beneish Models to assess the reliability

of marketing companies’ financial statements (2023–2024)

Source: Compiled by the authors

The analysis shows that in 60% of the studied marketing companies, either model did

not confirm the reliability of financial reporting. For 28% of the companies, reliability

was confirmed only according to the Roxas model, and for 6% - only according to the

Beneish model. Only 6% of the companies demonstrated consistent results across both

models, confirming the reliability of their financial statements. These findings

indicate a higher incidence of potential financial reporting manipulation among

marketing companies compared to the results reported by Repousis (2016) and

Lehenchuk et al. (2021), thereby highlighting an elevated level of financial abuse

directly in the marketing sector. This underscores the urgent need to develop and

implement tools aimed at minimizing such practices.

27