Page 94 - Azerbaijan State University of Economics

P. 94

Rajni Bala, Sandeep Singh, Kiran Sood and Simon Grima : Sustainable Finance and Investment

Analytics: A Systematic Literature Review and Meta-Analysis Approach

Following the PRISMA guidelines (refer to Figure 1 from the attached document), a

comprehensive and structured process was undertaken to identify and select studies for

this systematic review and meta-analysis. An initial pool of 2,792 records was identified

from the database. Out of these, 525 records were automatically excluded due to ineligible

publication years. The remaining 2,267 records were screened for thematic relevance,

resulting in the exclusion of 756 studies deemed irrelevant to the scope of sustainable

finance and investment analytics. From the 1,511 reports sought for retrieval, 915 could

not be accessed due to availability issues. A total of 596 reports were subsequently

assessed for eligibility, of which 209 were excluded due to misalignment with the research

theme. Ultimately, 387 studies were included in the broader review, and from this pool,

77 high-quality and data-complete studies were selected for final in-depth analysis. This

rigorous multi-stage filtering process ensured that only thematically aligned,

methodologically sound, and academically robust studies were incorporated into the

review.

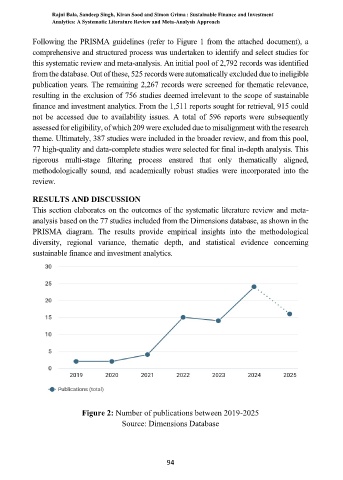

RESULTS AND DISCUSSION

This section elaborates on the outcomes of the systematic literature review and meta-

analysis based on the 77 studies included from the Dimensions database, as shown in the

PRISMA diagram. The results provide empirical insights into the methodological

diversity, regional variance, thematic depth, and statistical evidence concerning

sustainable finance and investment analytics.

Figure 2: Number of publications between 2019-2025

Source: Dimensions Database

94