Page 134 - Azerbaijan State University of Economics

P. 134

THE PUBLIC INVESTMENTS IN AZERBAIJAN: THEORETICAL AND PRACTICAL ASPECTS

50

43.2 42

48 48

37.7

40

30

20

10.6 13.6 12.9 12.9 12.7 12

14.8

7.6

10

6.7 2.4

1.6 2.3 2.5 10.3

1

0

2001 2002 2003 2004 2005 2006 2007 2008 2009 201

GDP State budget

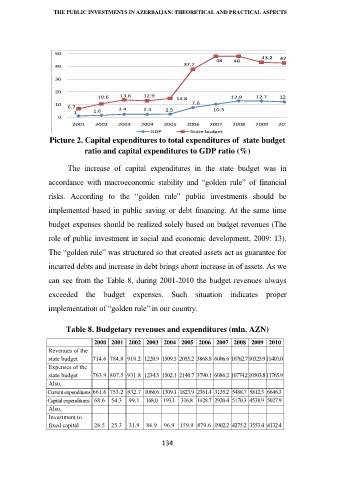

Picture 2. Capital expenditures to total expenditures of state budget

ratio and capital expenditures to GDP ratio (%)

The increase of capital expenditures in the state budget was in

accordance with macroeconomic stability and “golden rule” of financial

risks. According to the “golden rule” public investments should be

implemented based in public saving or debt financing. At the same time

budget expenses should be realized solely based on budget revenues (The

role of public investment in social and economic development, 2009: 13).

The “golden rule” was structured so that created assets act as guarantee for

incurred debts and increase in debt brings about increase in of assets. As we

can see from the Table 8, during 2001-2010 the budget revenues always

exceeded the budget expenses. Such situation indicates proper

implementation of “golden rule” in our country.

Table 8. Budgetary revenues and expenditures (mln. AZN)

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Revenues of the

state budget 714.6 784.8 910.2 1220.9 1509.5 2055.2 3868.8 6006.6 10762.710325.9 11403.0

Expenses of the

state budget 763.9 807.5 931.8 1234.5 1502.1 2140.7 3790.1 6086.2 10774.210503.8 11765.9

Also,

Current expenditures 661.6 753.2 832.7 1066.6 1309.1 1823.9 2361.4 3135.2 5488.7 5812.3 6646.3

Capital expenditures 68.6 54.3 99.1 168.0 193.1 316.8 1428.7 2920.4 5170.3 4538.9 5027.9

Also,

Investment to

fixed capital 26.5 25.3 31.9 86.9 96.9 159.9 879.6 1902.2 4275.2 3553.4 4132.4

134