Page 70 - Azerbaijan State University of Economics

P. 70

Fariz A. Guliyev: The economics of financial securities for environmental obligations and

their impact in royalty revenues from Alberta oil sands in North America

3.2. Uncertainties and limitations on Approval Holders` use of QETs

Although it seems that Approval Holders can impose as much QET as possible for their tax

purposes Alberta Environment would presumably limit voluntary QETs. Thus, voluntary

contributions, unlike mandatory QETs, would not qualify for tax deductions. This would have a

positive impact on the total amount of royalty collection. Another uncertainty would be a

hypothetical situation where the bitumen production ends whereas the Approval Holder has

substantial amounts of QET funded. Any subsequent withdrawal of QETs after the depletion of

mine reserves are not depicted anywhere in the current tax regulation.

Why Approval Holders would use QETs during periods with high oil prices?

The paper assumes that Approval Holders would use QETs to deduct costs and reduce

royalty revenues during prevailing crude prices. This is because royalty revenues increase as

WTI crude price goes up and Approval Holders would be willing to offset this increase by

reducing their taxable income together with their net royalty revenue. The paper has chosen the

year of 2011 to calculate royalty revenues for post payout projects of Alberta Energy in 2011:

The Crown`s royalty share of an oil sands product during a period is the greater of the

Gross Royalty Rate and the Net Royalty Rate (See Alberta Oil Sands Royalty Guidelines,

Principles and Procedures (October 11, 2012). Three separate formulas exist for different price

relationships for both Net and Gross methods of royalty calculation. For a Low<WTI<High

relationship we must use the formulas as they are given in the section above.).

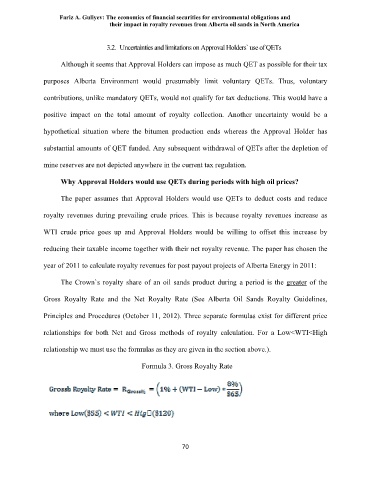

Formula 3. Gross Royalty Rate

70