Page 26 - Azerbaijan State University of Economics

P. 26

Aynur Suleymanova: Assessment of Laffer Points of the I and II Types of VAT (on the

Example of Russian Federation, Kazakhstan and Azerbaijan Republics

2,000,000

1,600,000

800,000 1,200,000

400,000 800,000

0 400,000

-400,000

-800,000

06 07 08 09 10 11 12 13 14 15 16 17

Residual Actual Fitted

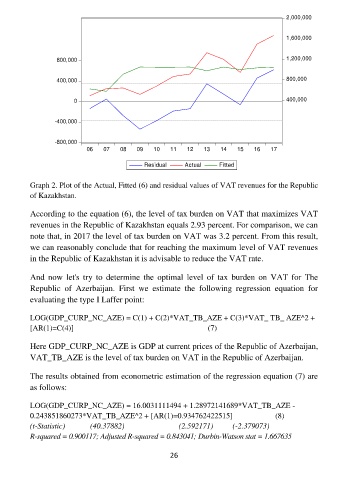

Graph 2. Plot of the Actual, Fitted (6) and residual values of VAT revenues for the Republic

of Kazakhstan.

According to the equation (6), the level of tax burden on VAT that maximizes VAT

revenues in the Republic of Kazakhstan equals 2.93 percent. For comparison, we can

note that, in 2017 the level of tax burden on VAT was 3.2 percent. From this result,

we can reasonably conclude that for reaching the maximum level of VAT revenues

in the Republic of Kazakhstan it is advisable to reduce the VAT rate.

And now let's try to determine the optimal level of tax burden on VAT for The

Republic of Azerbaijan. First we estimate the following regression equation for

evaluating the type I Laffer point:

LOG(GDP_CURP_NC_AZE) = C(1) + C(2)*VAT_TB_AZE + C(3)*VAT_ TB_ AZE^2 +

[AR(1)=C(4)] (7)

Here GDP_CURP_NC_AZE is GDP at current prices of the Republic of Azerbaijan,

VAT_TB_AZE is the level of tax burden on VAT in the Republic of Azerbaijan.

The results obtained from econometric estimation of the regression equation (7) are

as follows:

LOG(GDP_CURP_NC_AZE) = 16.0031111494 + 1.28972141689*VAT_TB_AZE -

0.243851860273*VAT_TB_AZE^2 + [AR(1)=0.934762422515] (8)

(t-Statistic) (40.37882) (2.592171) (-2.379073)

R-squared = 0.900117; Adjusted R-squared = 0.843041; Durbin-Watson stat = 1.667635

26