Page 23 - Azerbaijan State University of Economics

P. 23

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.79, # 2, 2022, pp. 19-36

GDP = The sum of the gross value added at basic prices plus all taxes on products,

less all subsidies on products

Value added = Compensation of employees + Mixed income + Other taxes less

subsidies on production + Gross operating surplus

Gross operating surplus = Net operating surplus + Consumption of fixed capital.

The share of interest incomes on loans granted by banks of Azerbaijan for 2018-2021

averaged 58% of total bank incomes which includes the interest and non-interest

incomes. (Source: Calculation made by author based on data obtained from the official

web-site of Central Bank of the Republic of Azerbaijan, https://www.cbar.az/). In the

study the accrued interest incomes calculated on bank loans divided by GDP is defined

as interest burden. Theoretically, a rise in the interest burden results in delays and non-

payment of debts in the economy, which causes the establishment of special reserves

funds by banks for outstanding debts (both principal and interest) by debiting of profit

and loss account. As a rule, special reserve funds are created at the expense of banks,

which in its turn has a reducing effect on the profits of banks. An increase in the

interest burden theoretically has an effect on banks' profits. However, there is a certain

point at which the impact of the interest burden on the bank's profits reaches its

maximum. After this point, the interest burden reduces the solvency of borrowers and,

consequently, leads to delays or defaults, which reduces the profitability of the bank

by increasing the cost of the reserve fund. Because the reserves are created at the

expense of the bank for the total amount of loans. (The Chamber for Control over

Financial Markets of the Republic of Azerbaijan, 2018, http://www.e-

qanun.az/framework/40823).

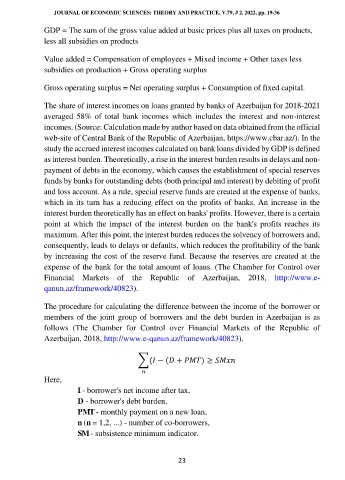

The procedure for calculating the difference between the income of the borrower or

members of the joint group of borrowers and the debt burden in Azerbaijan is as

follows (The Chamber for Control over Financial Markets of the Republic of

Azerbaijan, 2018, http://www.e-qanun.az/framework/40823).

∑( − ( + ) ≥

Here,

I - borrower's net income after tax,

D - borrower's debt burden,

PMT - monthly payment on a new loan,

n (n = 1,2, ...) - number of co-borrowers,

SM - subsistence minimum indicator.

23