Page 73 - Azerbaijan State University of Economics

P. 73

Murad Yusifov: Modelling the inflationary processes and forecasting:an application of ARIMA,

SARIMA models

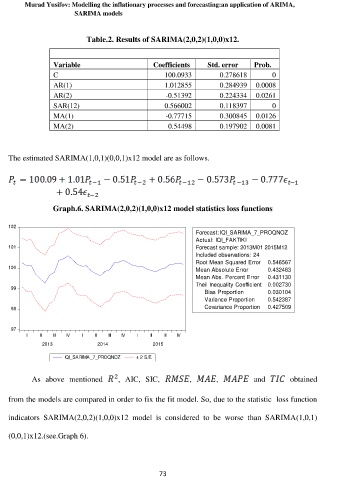

Table.2. Results of SARIMA(2,0,2)(1,0,0)x12.

Variable Coefficients Std. error Prob.

C 100.0933 0.278618 0

AR(1) 1.012855 0.284939 0.0008

AR(2) -0.51392 0.224334 0.0261

SAR(12) 0.566002 0.118397 0

MA(1) -0.77715 0.300845 0.0126

MA(2) 0.54498 0.197902 0.0081

The estimated SARIMA(1,0,1)(0,0,1)x12 model are as follows.

Graph.6. SARIMA(2,0,2)(1,0,0)x12 model statistics loss functions

102

Forecast: IQI_SARIMA_7_PROQNOZ

Actual: IQI_FAKTIKI

101 Forecast sample: 2013M01 2015M12

Included observations: 24

Root Mean Squared Error 0.546567

100 Mean Absolute Error 0.432463

Mean Abs. Percent Error 0.431130

Theil Inequality Coefficient 0.002730

99

Bias Proportion 0.030104

Variance Proportion 0.542387

98 Covariance Proportion 0.427509

97

I II III IV I II III IV I II III IV

2013 2014 2015

IQI_SARIMA_7_PROQNOZ ± 2 S.E.

As above mentioned , AIC, SIC, , , and obtained

from the models are compared in order to fix the fit model. So, due to the statistic loss function

indicators SARIMA(2,0,2)(1,0,0)x12 model is considered to be worse than SARIMA(1,0,1)

(0,0,1)x12.(see.Graph 6).

73