Page 100 - Azerbaijan State University of Economics

P. 100

A.Y.Abbasov: How U.S. government expansionary monetary policy helps to lower the

interest rates of mortgages

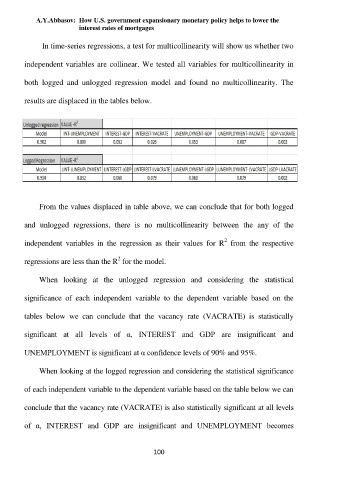

In time-series regressions, a test for multicollinearity will show us whether two

independent variables are collinear. We tested all variables for multicollinearity in

both logged and unlogged regression model and found no multicollinearity. The

results are displaced in the tables below.

From the values displaced in table above, we can conclude that for both logged

and unlogged regressions, there is no multicollinearity between the any of the

2

independent variables in the regression as their values for R from the respective

2

regressions are less than the R for the model.

When looking at the unlogged regression and considering the statistical

significance of each independent variable to the dependent variable based on the

tables below we can conclude that the vacancy rate (VACRATE) is statistically

significant at all levels of α, INTEREST and GDP are insignificant and

UNEMPLOYMENT is significant at α confidence levels of 90% and 95%.

When looking at the logged regression and considering the statistical significance

of each independent variable to the dependent variable based on the table below we can

conclude that the vacancy rate (VACRATE) is also statistically significant at all levels

of α, INTEREST and GDP are insignificant and UNEMPLOYMENT becomes

100