Page 98 - Azerbaijan State University of Economics

P. 98

A.Y.Abbasov: How U.S. government expansionary monetary policy helps to lower the

interest rates of mortgages

relationship between VACRATE and HOUSE should be negative as with the

decrease of vacant homes one should see increase in housing sales.

REGRESSION ANALYSIS

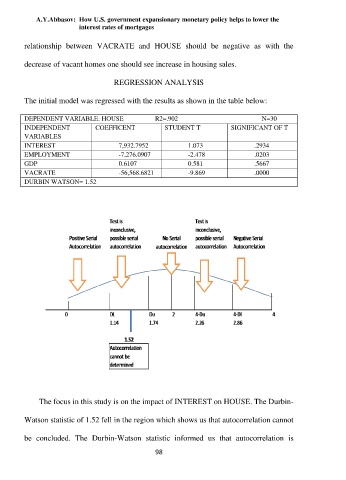

The initial model was regressed with the results as shown in the table below:

DEPENDENT VARIABLE: HOUSE R2=.902 N=30

INDEPENDENT COEFFICENT STUDENT T SIGNIFICANT OF T

VARIABLES

INTEREST 7,932.7952 1.073 .2934

EMPLOYMENT -7,276.0907 -2.478 .0203

GDP 0.6107 0.581 .5667

VACRATE -56,568.6821 -9.869 .0000

DURBIN WATSON= 1.52

The focus in this study is on the impact of INTEREST on HOUSE. The Durbin-

Watson statistic of 1.52 fell in the region which shows us that autocorrelation cannot

be concluded. The Durbin-Watson statistic informed us that autocorrelation is

98