Page 11 - Azerbaijan State University of Economics

P. 11

Shaikh A. Hamid, Tej S. Dhakar: Anamolous Behavior of the Volatility of Nasdaq

Composite Index: 1971 To 2017

Note: “Positive” implies the mean of monthly changes was significantly greater than

zero “Higher” implies the mean of absolute percent changes or the variance of

absolute percent changes for a month was significantly higher than those of the other

eleven months stacked; “Lower” implies the mean or the variance of absolute percent

changes for a month was significantly lower than those of the other eleven months

stacked. Numbers are rounded in all tables to two decimal places.

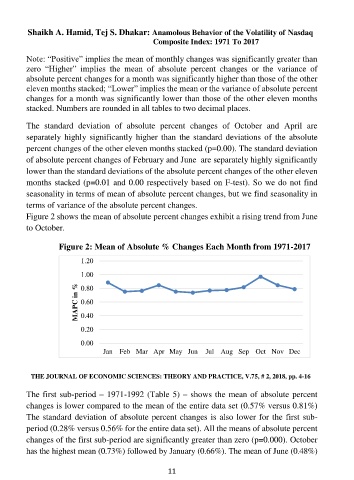

The standard deviation of absolute percent changes of October and April are

separately highly significantly higher than the standard deviations of the absolute

percent changes of the other eleven months stacked (p=0.00). The standard deviation

of absolute percent changes of February and June are separately highly significantly

lower than the standard deviations of the absolute percent changes of the other eleven

months stacked (p=0.01 and 0.00 respectively based on F-test). So we do not find

seasonality in terms of mean of absolute percent changes, but we find seasonality in

terms of variance of the absolute percent changes.

Figure 2 shows the mean of absolute percent changes exhibit a rising trend from June

to October.

Figure 2: Mean of Absolute % Changes Each Month from 1971-2017

1.20

1.00

MAPC in % 0.60

0.80

0.40

0.20

0.00

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.75, # 2, 2018, pp. 4-16

The first sub-period – 1971-1992 (Table 5) – shows the mean of absolute percent

changes is lower compared to the mean of the entire data set (0.57% versus 0.81%)

The standard deviation of absolute percent changes is also lower for the first sub-

period (0.28% versus 0.56% for the entire data set). All the means of absolute percent

changes of the first sub-period are significantly greater than zero (p=0.000). October

has the highest mean (0.73%) followed by January (0.66%). The mean of June (0.48%)

11