Page 114 - Azerbaijan State University of Economics

P. 114

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.81, # 2, 2024, pp. 104-116

To choose the ARDL model, the Schwarz Information Criterion (SIC) was utilised.

There was no long-term correlation between employment and human capital,

according to the particular test. Using the Ordinary Least Squares (OLS) approach,

the short-term model was estimated using the SIC selection criteria and the related

error corrective term test. The long-, short-, and short Run models' results are shown

in Table 6. Government spending on education was substantial in the near term, and

its long-term convergence adjustment speed was -0.375173, meaning that short-term

to long-term differences would be corrected at a pace of 37.51%.

In contrast to government spending on education, the long-term estimate findings

showed that government spending on health (HEXP) and life expectancy at birth

(LEB) both had negative coefficients. There is a positive long-term association

between the total labor force (LPR), inflation rate (INF), and education level (EDU).

The long-term effects of China's government spending on education are responsible

for this phenomena, since it raises the employment rate in the Chinese labor market

by polarizing the competences of university and institute graduates. This, in turn,

makes it easier for the macroeconomy to generate additional value through increased

productivity, which in turn boosts domestic demand for goods. A strong employment

participation rate enables graduates to join the Chinese labor market and contributes

to a higher employment rate, although consumption includes a high rate of inflation.

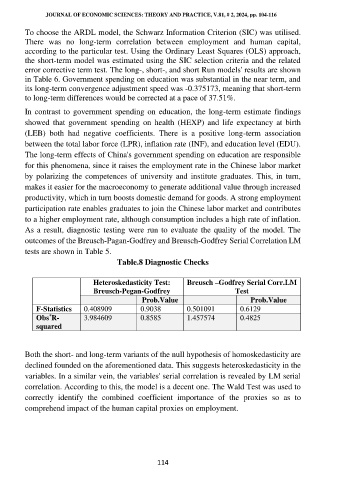

As a result, diagnostic testing were run to evaluate the quality of the model. The

outcomes of the Breusch-Pagan-Godfrey and Breusch-Godfrey Serial Correlation LM

tests are shown in Table 5.

Table.8 Diagnostic Checks

Heteroskedasticity Test: Breusch –Godfrey Serial Corr.LM

Breusch-Pegan-Godfrey Test

Prob.Value Prob.Value

F-Statistics 0.408909 0.9038 0.501091 0.6129

*

Obs R- 3.984609 0.8585 1.457574 0.4825

squared

Both the short- and long-term variants of the null hypothesis of homoskedasticity are

declined founded on the aforementioned data. This suggests heteroskedasticity in the

variables. In a similar vein, the variables' serial correlation is revealed by LM serial

correlation. According to this, the model is a decent one. The Wald Test was used to

correctly identify the combined coefficient importance of the proxies so as to

comprehend impact of the human capital proxies on employment.

114