Page 101 - Azerbaijan State University of Economics

P. 101

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE

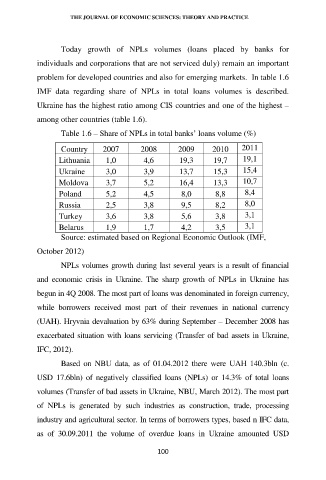

Today growth of NPLs volumes (loans placed by banks for

individuals and corporations that are not serviced duly) remain an important

problem for developed countries and also for emerging markets. In table 1.6

IMF data regarding share of NPLs in total loans volumes is described.

Ukraine has the highest ratio among CIS countries and one of the highest –

among other countries (table 1.6).

Table 1.6 – Share of NPLs in total banks’ loans volume (%)

Country 2007 2008 2009 2010 2011

Lithuania 1,0 4,6 19,3 19,7 19,1

Ukraine 3,0 3,9 13,7 15,3 15,4

Moldova 3,7 5,2 16,4 13,3 10,7

Poland 5,2 4,5 8,0 8,8 8,4

Russia 2,5 3,8 9,5 8,2 8,0

Turkey 3,6 3,8 5,6 3,8 3,1

Belarus 1,9 1,7 4,2 3,5 3,1

Source: estimated based on Regional Economic Outlook (IMF,

October 2012)

NPLs volumes growth during last several years is a result of financial

and economic crisis in Ukraine. The sharp growth of NPLs in Ukraine has

begun in 4Q 2008. The most part of loans was denominated in foreign currency,

while borrowers received most part of their revenues in national currency

(UAH). Hryvnia devaluation by 63% during September – December 2008 has

exacerbated situation with loans servicing (Transfer of bad assets in Ukraine,

IFC, 2012).

Based on NBU data, as of 01.04.2012 there were UAH 140.3bln (c.

USD 17.6bln) of negatively classified loans (NPLs) or 14.3% of total loans

volumes (Transfer of bad assets in Ukraine, NBU, March 2012). The most part

of NPLs is generated by such industries as construction, trade, processing

industry and agricultural sector. In terms of borrowers types, based n IFC data,

as of 30.09.2011 the volume of overdue loans in Ukraine amounted USD

100