Page 98 - Azerbaijan State University of Economics

P. 98

CONTRIBUTION OF BANKING SYSTEM INTO FINANCIAL STABILITY OF UKRAINE

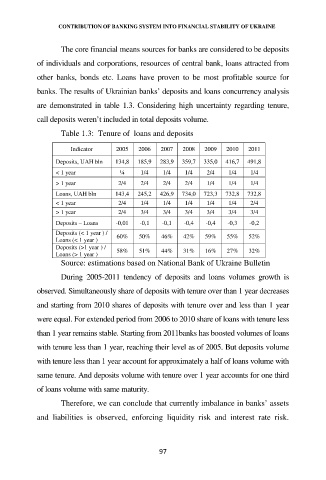

The core financial means sources for banks are considered to be deposits

of individuals and corporations, resources of central bank, loans attracted from

other banks, bonds etc. Loans have proven to be most profitable source for

banks. The results of Ukrainian banks’ deposits and loans concurrency analysis

are demonstrated in table 1.3. Considering high uncertainty regarding tenure,

call deposits weren’t included in total deposits volume.

Table 1.3: Tenure of loans and deposits

Indicator 2005 2006 2007 2008 2009 2010 2011

Deposits, UAH bln 134,8 185,9 283,9 359,7 335,0 416,7 491,8

< 1 year ¼ 1/4 1/4 1/4 2/4 1/4 1/4

> 1 year 2/4 2/4 2/4 2/4 1/4 1/4 1/4

Loans, UAH bln 143,4 245,2 426,9 734,0 723,3 732,8 732,8

< 1 year 2/4 1/4 1/4 1/4 1/4 1/4 2/4

> 1 year 2/4 3/4 3/4 3/4 3/4 3/4 3/4

Deposits – Loans -0,01 -0,1 -0,1 -0,4 -0,4 -0,3 -0,2

Deposits (< 1 year ) / 60% 50% 46% 42% 59% 55% 52%

Loans (< 1 year )

Deposits (>1 year ) / 58% 51% 44% 31% 16% 27% 32%

Loans (> 1 year )

Source: estimations based on National Bank of Ukraine Bulletin

During 2005-2011 tendency of deposits and loans volumes growth is

observed. Simultaneously share of deposits with tenure over than 1 year decreases

and starting from 2010 shares of deposits with tenure over and less than 1 year

were equal. For extended period from 2006 to 2010 share of loans with tenure less

than 1 year remains stable. Starting from 2011banks has boosted volumes of loans

with tenure less than 1 year, reaching their level as of 2005. But deposits volume

with tenure less than 1 year account for approximately a half of loans volume with

same tenure. And deposits volume with tenure over 1 year accounts for one third

of loans volume with same maturity.

Therefore, we can conclude that currently imbalance in banks’ assets

and liabilities is observed, enforcing liquidity risk and interest rate risk.

97