Page 95 - Azerbaijan State University of Economics

P. 95

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE

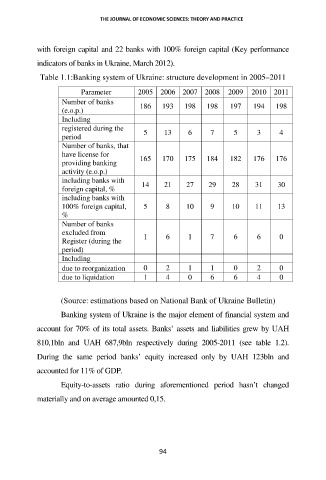

with foreign capital and 22 banks with 100% foreign capital (Key performance

indicators of banks in Ukraine, March 2012).

Table 1.1:Banking system of Ukraine: structure development in 2005–2011

Parameter 2005 2006 2007 2008 2009 2010 2011

Number of banks

(e.o.p.) 186 193 198 198 197 194 198

Including

registered during the

period 5 13 6 7 5 3 4

Number of banks, that

have license for 165 170 175 184 182 176 176

providing banking

activity (e.o.p.)

including banks with 14 21 27 29 28 31 30

foreign capital, %

including banks with

100% foreign capital, 5 8 10 9 10 11 13

%

Number of banks

excluded from 1 6 1 7 6 6 0

Register (during the

period)

Including

due to reorganization 0 2 1 1 0 2 0

due to liquidation 1 4 0 6 6 4 0

(Source: estimations based on National Bank of Ukraine Bulletin)

Banking system of Ukraine is the major element of financial system and

account for 70% of its total assets. Banks’ assets and liabilities grew by UAH

810,1bln and UAH 687,9bln respectively during 2005-2011 (see table 1.2).

During the same period banks’ equity increased only by UAH 123bln and

accounted for 11% of GDP.

Equity-to-assets ratio during aforementioned period hasn’t changed

materially and on average amounted 0,15.

94