Page 36 - Azerbaijan State University of Economics

P. 36

Turaj Musayev: The Oil Boom in Azerbaijan and Modeling of Economic Growth in Post-Oil Era

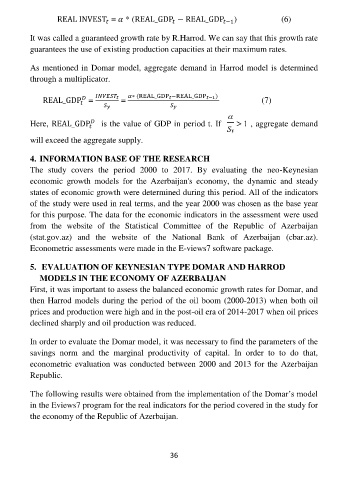

REAL INVEST = * (REAL_GDP − REAL_GDP −1 ) (6)

It was called a guaranteed growth rate by R.Harrod. We can say that this growth rate

guarantees the use of existing production capacities at their maximum rates.

As mentioned in Domar model, aggregate demand in Harrod model is determined

through a multiplicator.

REAL_GDP = = ∗ (REAL_GDP −REAL_GDP −1 ) (7)

Here, REAL_GDP is the value of GDP in period t. If 1 , aggregate demand

will exceed the aggregate supply.

4. INFORMATION BASE OF THE RESEARCH

The study covers the period 2000 to 2017. By evaluating the neo-Keynesian

economic growth models for the Azerbaijan's economy, the dynamic and steady

states of economic growth were determined during this period. All of the indicators

of the study were used in real terms, and the year 2000 was chosen as the base year

for this purpose. The data for the economic indicators in the assessment were used

from the website of the Statistical Committee of the Republic of Azerbaijan

(stat.gov.az) and the website of the National Bank of Azerbaijan (cbar.az).

Econometric assessments were made in the E-views7 software package.

5. EVALUATION OF KEYNESIAN TYPE DOMAR AND HARROD

MODELS IN THE ECONOMY OF AZERBAIJAN

First, it was important to assess the balanced economic growth rates for Domar, and

then Harrod models during the period of the oil boom (2000-2013) when both oil

prices and production were high and in the post-oil era of 2014-2017 when oil prices

declined sharply and oil production was reduced.

In order to evaluate the Domar model, it was necessary to find the parameters of the

savings norm and the marginal productivity of capital. In order to to do that,

econometric evaluation was conducted between 2000 and 2013 for the Azerbaijan

Republic.

The following results were obtained from the implementation of the Domar’s model

in the Eviews7 program for the real indicators for the period covered in the study for

the economy of the Republic of Azerbaijan.

36