Page 37 - Azerbaijan State University of Economics

P. 37

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.76, # 2, 2019, pp. 31-45

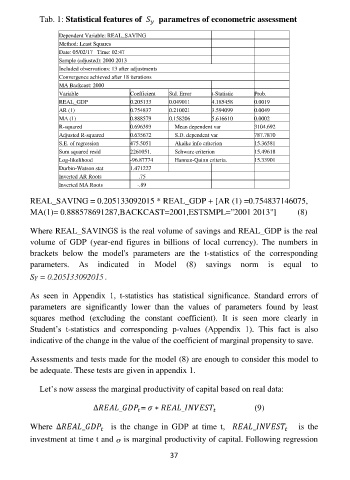

Tab. 1: Statistical features of parametres of econometric assessment

Dependent Variable: REAL_SAVING

Method: Least Squares

Date: 05/02/17 Time: 02:47

Sample (adjusted): 2000 2013

Included observations: 13 after adjustments

Convergence achieved after 18 iterations

MA Backcast: 2000

Variable Coefficient Std. Error t-Statistic Prob.

REAL_GDP 0.205133 0.049011 4.185458 0.0019

AR (1) 0.754837 0.210021 3.594099 0.0049

MA (1) 0.888579 0.158206 5.616610 0.0002

R-squared 0.696393 Mean dependent var 3104.692

Adjusted R-squared 0.635672 S.D. dependent var 787.7870

S.E. of regression 475.5051 Akaike info criterion 15.36581

Sum squared resid 2261051. Schwarz criterion 15.49618

Log-likelihood -96.87774 Hannan-Quinn criteria. 15.33901

Durbin-Watson stat 1.471227

Inverted AR Roots .75

Inverted MA Roots -.89

REAL_SAVING = 0.205133092015 * REAL_GDP + [AR (1) =0.754837146075,

MA(1)= 0.888578691287,BACKCAST=2001,ESTSMPL="2001 2013"] (8)

Where REAL_SAVINGS is the real volume of savings and REAL_GDP is the real

volume of GDP (year-end figures in billions of local currency). The numbers in

brackets below the model's parameters are the t-statistics of the corresponding

parameters. As indicated in Model (8) savings norm is equal to

.

As seen in Appendix 1, t-statistics has statistical significance. Standard errors of

parameters are significantly lower than the values of parameters found by least

squares method (excluding the constant coefficient). It is seen more clearly in

Student’s t-statistics and corresponding p-values (Appendix 1). This fact is also

indicative of the change in the value of the coefficient of marginal propensity to save.

Assessments and tests made for the model (8) are enough to consider this model to

be adequate. These tests are given in appendix 1.

Let’s now assess the marginal productivity of capital based on real data:

∆ _ = ∗ _ (9)

Where ∆ _ is the change in GDP at time t, _ is the

investment at time t and is marginal productivity of capital. Following regression

37