Page 38 - Azerbaijan State University of Economics

P. 38

Turaj Musayev: The Oil Boom in Azerbaijan and Modeling of Economic Growth in Post-Oil Era

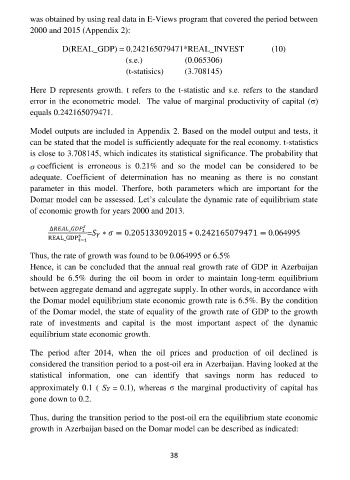

was obtained by using real data in E-Views program that covered the period between

2000 and 2015 (Appendix 2):

D(REAL_GDP) = 0.242165079471*REAL_INVEST (10)

(s.e.) (0.065306)

(t-statisics) (3.708145)

Here D represents growth. t refers to the t-statistic and s.e. refers to the standard

error in the econometric model. The value of marginal productivity of capital (σ)

equals 0.242165079471.

Model outputs are included in Appendix 2. Based on the model output and tests, it

can be stated that the model is sufficiently adequate for the real economy. t-statistics

is close to 3.708145, which indicates its statistical significance. The probability that

coefficient is erroneous is 0.21% and so the model can be considered to be

adequate. Coefficient of determination has no meaning as there is no constant

parameter in this model. Therfore, both parameters which are important for the

Domar model can be assessed. Let’s calculate the dynamic rate of equilibrium state

of economic growth for years 2000 and 2013.

Δ _ = ∗ = 0.205133092015 ∗ 0.242165079471 = 0.064995

REAL_GDP s t−1

Thus, the rate of growth was found to be 0.064995 or 6.5%

Hence, it can be concluded that the annual real growth rate of GDP in Azerbaijan

should be 6.5% during the oil boom in order to maintain long-term equilibrium

between aggregate demand and aggregate supply. In other words, in accordance with

the Domar model equilibrium state economic growth rate is 6.5%. By the condition

of the Domar model, the state of equality of the growth rate of GDP to the growth

rate of investments and capital is the most important aspect of the dynamic

equilibrium state economic growth.

The period after 2014, when the oil prices and production of oil declined is

considered the transition period to a post-oil era in Azerbaijan. Having looked at the

statistical information, one can identify that savings norm has reduced to

approximately 0.1 ( 0.1), whereas σ the marginal productivity of capital has

gone down to 0.2.

Thus, during the transition period to the post-oil era the equilibrium state economic

growth in Azerbaijan based on the Domar model can be described as indicated:

38