Page 39 - Azerbaijan State University of Economics

P. 39

THE JOURNAL OF ECONOMIC SCIENCES: THEORY AND PRACTICE, V.76, # 2, 2019, pp. 31-45

Δ _ = ∗ = 0.1 *0.2 = 0.02, in other words 2%.

s

_ t−1

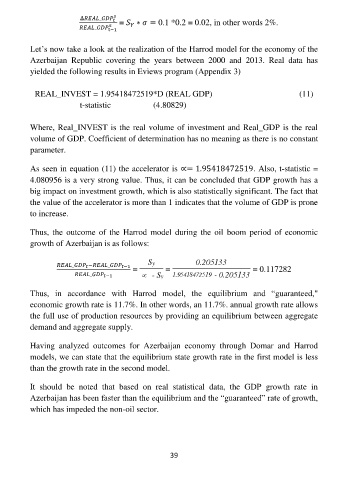

Let’s now take a look at the realization of the Harrod model for the economy of the

Azerbaijan Republic covering the years between 2000 and 2013. Real data has

yielded the following results in Eviews program (Appendix 3)

REAL_INVEST = 1.95418472519*D (REAL GDP) (11)

t-statistic (4.80829)

Where, Real_INVEST is the real volume of investment and Real_GDP is the real

volume of GDP. Coefficient of determination has no meaning as there is no constant

parameter.

As seen in equation (11) the accelerator is ∝= 1.95418472519. Also, t-statistic =

4.080956 is a very strong value. Thus, it can be concluded that GDP growth has a

big impact on investment growth, which is also statistically significant. The fact that

the value of the accelerator is more than 1 indicates that the volume of GDP is prone

to increase.

Thus, the outcome of the Harrod model during the oil boom period of economic

growth of Azerbaijan is as follows:

_ − _ −1

= = = 0.117282

_ −1

Thus, in accordance with Harrod model, the equilibrium and “guaranteed,"

economic growth rate is 11.7%. In other words, an 11.7%. annual growth rate allows

the full use of production resources by providing an equilibrium between aggregate

demand and aggregate supply.

Having analyzed outcomes for Azerbaijan economy through Domar and Harrod

models, we can state that the equilibrium state growth rate in the first model is less

than the growth rate in the second model.

It should be noted that based on real statistical data, the GDP growth rate in

Azerbaijan has been faster than the equilibrium and the “guaranteed” rate of growth,

which has impeded the non-oil sector.

39